Services

Equipped with an AI credit scoring model, ScoreLink is ready to connect you with the microfinance institution of your choice.

Why now?

ScoreLink enters the market at an opportune time, capitalizing on the advent of four fundamental infrastructure conditions in Bangladesh:

Fast penetration of broadband (4G) networks

Broad use of smartphones, even in rural areas

Mandatory adoption of smart National IDs, making digital identity authentication possible

Emergence and growing popularity of mobile payment and digital wallets

Traditional microfinance institutions (MFIs) face two key barriers: high cost and high risk, caused by small loan sizes, large geographical spread, and the inherent difficulty in assessing the default risk of individuals without credit profiles.

As a result, MFIs mush charge exorbitant interest rates.

And 99% of MFIs rely on donor funding.

SCORELINK’S SOLUTION

Digitization

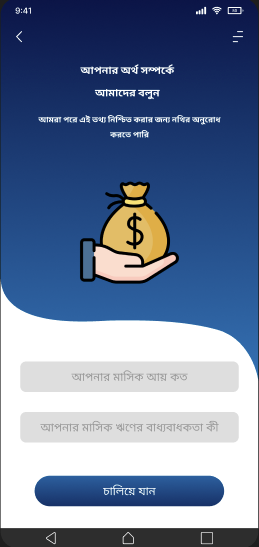

Scorelink digitizes the loan origination process through a user-friendly mobile app to facilitate interactions between MFIs and remote microfinance applicants.

AI-based Algorithm

ScoreLink uses gradient boosting machines (GBMs) to predict the risk of default. This algorithm was deliberately chosen among other options to strike a balance between prediction accuracy and interpretability of the target-feature relationships.

Through a credit scoring model that leverages mobile phone data, ScoreLink will accurately assess the creditworthiness of millions of loan applicants without a prior credit history.

AI-based Credit Scoring

Mobile phone data

What sets ScoreLink apart is its innovative use of mobile phone data for credit scoring. With users’ permission, ScoreLink collects both device and behavioral data to model applicants’ characteristics, offering insights into their ability and willingness to repay their loans.

At ScoreLink, we strive for the Four L’s.

Low-Interest Loans

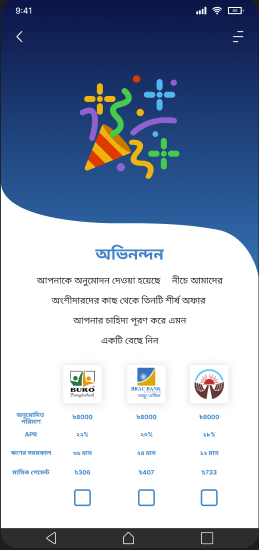

ScoreLink creates a competitive online marketplace, encouraging MFIs to reduce interest rates in order for them to stay competitive. This becomes achievable through the cost reductions that ScoreLink introduces to the industry.

Lowered Costs for MFIs

ScoreLink’s mobile app and credit scoring model will streamline microfinance operations via digitization and reduce default rates by improving upon existing methods of assessing creditworthiness.

Linking Rural Communities

By eliminating the need for an in-person loan application, ScoreLink allows microfinance institutions to reach rural communities through highly convenient, real-time digital financing services.

Loan Safety

Using cutting-edge AI-based credit scoring, ScoreLink will augment the loan safety of microfinance institutions by assessing the creditworthiness of prospective borrowers, reducing the risk of default.

ScoreLink offers unique value by creating a platform that serves the needs of both microfinance institutions and borrowers.

Value Proposition

For MFIs…

ScoreLink brings improved efficiency, reduced costs, lower risk, effective coverage in remote areas, and an expanded customer base.

For borrowers…

ScoreLink brings faster loan processing, lower interest rates, improved access to financial services, and the ability to choose from multiple loan offers.

Mobile App Preview

Services FAQs

-

1) Digitized Loan Application Platform: Our mobile app simplifies and streamlines the loan application process by creating a convenient platform for borrowers to connect with MFIs.

2) AI-Based Credit Scoring: We use a predictive AI model trained on mobile phone data to assess the creditworthiness of borrowers, reducing the risk of default.

-

Mobile phone data is collected as part of ScoreLink’s unique AI-based credit scoring model, which is a core part of its business solution. We ensure that no potentially discriminatory information is used to train the model in order to uphold fairness in lending. Additionally, ScoreLink sticks to the highest standard of data protection and privacy practices, strictly adhering to all government regulations.

-

ScoreLink takes no additional fees from borrowers using our lending platform, meaning it is free to use for prospective borrowers before they take out a loan.

For microfinance institutions ScoreLink charges a small subscription fee and a 0.1% service fee on loans transacted through our platform.

-

Unfortunately, ScoreLink’s services are not available at this time as we are still in the development phase. However, our team is working to form partnerships, establish brand awareness, and launch our offerings in the very near future.